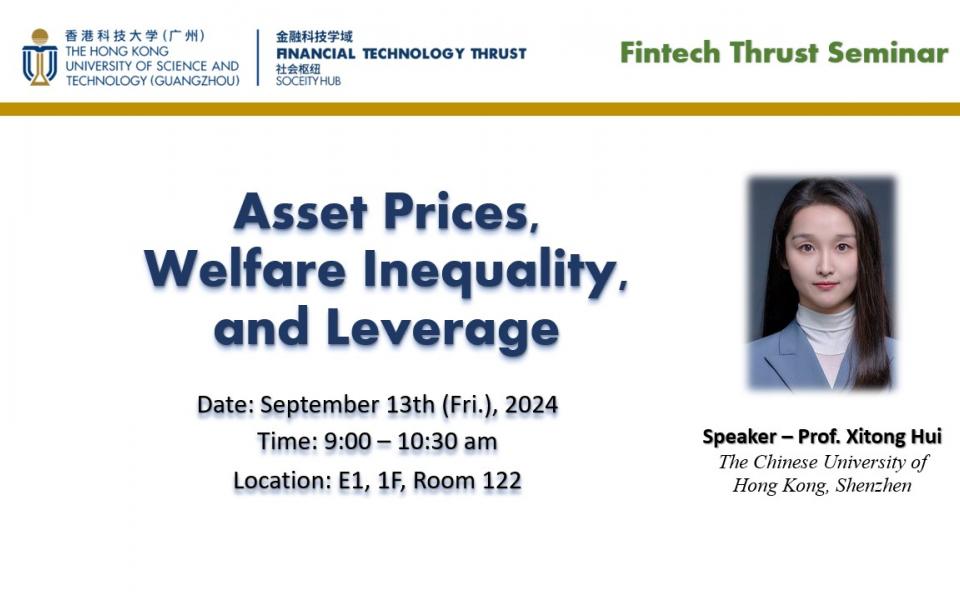

FINTECH THRUST SEMINAR | Asset Prices, Welfare Inequality, and Leverage

Supporting the below United Nations Sustainable Development Goals:支持以下聯合國可持續發展目標:支持以下联合国可持续发展目标:

Asset Prices, Welfare Inequality, and Leverage

Abstract:

Do rising asset prices make savers better off? The traditional way to answer this question is to study wealth inequality. This paper studies the effect of fundamental drivers of rising asset prices (a fall in time discount rate, an increase in productivity, financial innovation, or a bubble driven by financial frictions) on top welfare inequality between super rich entrepreneurs and savers through leverage. Using a model with financial frictions, idiosyncratic risks, and unequal capital income, I show that different fundamental drivers of rising asset prices move wealth inequality and savers’ welfare in different directions by affecting leverage differently. Given the rising asset prices, falling risk-free rates, and rising top wealth inequality observed in the U.S., the model suggests that the falling time discount rate of the super-rich is the main driver of the trend, and therefore savers are worse off.

Xitong Hui received her Ph.D. degree in Economics from the London School of Economics and Political Science (LSE). Before that, she earned her master’s degree in Econometrics and Mathematical Economics from LSE and her Bachelor’s degree in Mathematical Economics from the Central University of Finance and Economics. Her main research interest is macro-finance and international finance. She is interested in how asset prices affect wealth inequality and welfare inequality. She also works on international finance topics such as the determination of sovereign bond safety and the Internationalization of currency (RMB).