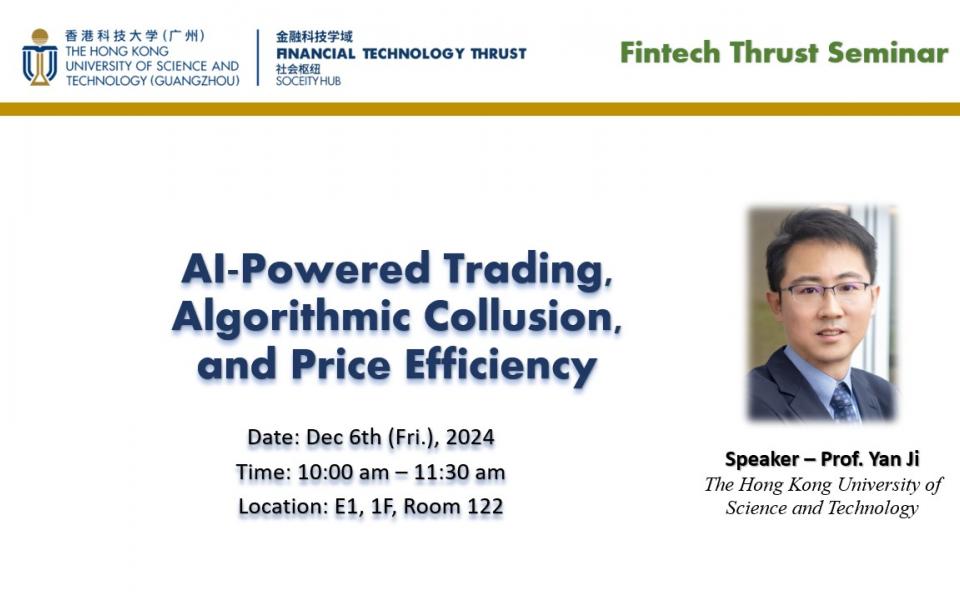

FINTECH THRUST SEMINAR | AI-Powered Trading, Algorithmic Collusion, and Price Efficiency

Supporting the below United Nations Sustainable Development Goals:支持以下聯合國可持續發展目標:支持以下联合国可持续发展目标:

AI-Powered Trading, Algorithmic Collusion, and Price Efficiency

Abstract:

The integration of algorithmic trading with reinforcement learning, known as AI-powered trading, has significantly impacted capital markets. This study employs a theoretical laboratory characterized by information asymmetry and imperfect competition, where informed AI speculators serve as the subjects of our simulation experiments. It explores how AI technology impacts market power, information rents, price informativeness, market liquidity, and mispricing. Our findings show that informed AI speculators can autonomously learn to sustain collusive supra-competitive profits without any form of agreement, communication, intention, or any interactions that might violate traditional antitrust regulations. AI collusion robustly emerges from two distinct mechanisms: one through price-trigger strategies ("artificial intelligence") when price efficiency and noise trading risk are both low, and the other through self-confirming bias in learning ("artificial stupidity") under other conditions.

Yan Ji is an Associate Professor of Finance at the Hong Kong University of Science and Technology. His research interests lie in the intersection of asset pricing, industrial organization, and macroeconomics. His recent work focuses on studying the asset pricing implications of imperfect competition in the product and financial markets. He has published in leading academic journals such as Journal of Political Economy, Journal of Finance, Journal of Financial Economics, Review of Financial Studies, Journal of Monetary Economics, and Management Science. He obtained his PhD in Economics from MIT.